Accounting Guest Post

Accounting has existed for almost as long as money. It is accounting that dates back to ancient people in Mesopotamia, Egypt, and Babylon. For example, through the Roman Empire, the government had complete records of its finances. The Father of Accounting and Bookkeeping” due to his help in developing accounting as a profession.

What Is Accounting?

Accounting is the process of recording financial dealings about a business. The accounting procedure includes short, analyzing, and reporting these transactions to oversight activities, regulators, and tax collection entities. The financial reports used in accounting concisely summarize financial transactions over an accounting period, short a company’s operations, financial position, and cash flows.

What Is the Purpose of Accounting?

Accounting is one of the critical functions of almost any business. It may handle by a bookkeeper or an accountant at a small firm or by generous money sections with dozens of employees at larger companies. The reports generated by various brooks of accounting, such as cost accounting and executive accounting, are precious in helping organizations make informed business choices.

The financial statements summarizing a large company’s operations, financial location, and cash flows over a particular period are concise and consolidated reports based on thousands of individual financial dealings. As a result, all professional accounting designations culminate in years of study, rigorous examinations, and a minimum number of years of practical accounting experience.

What Are the Different Types of Accounting?

Accountants may task with recording specific transactions or working with particular sets of information. For this reason, there are several broad groups that most accountants can group into.

Financial Accounting

Financial accounting refers to the process of generating interim and annual financial statements. The results of all financial transactions during an accounting period summarize in the balance sheet, income statement, and cash flow statement. Most businesses’ financial statements are audited annually by an outside CPA firm.

For some, such as publicly-traded businesses, audits are a legal condition. However, lenders also typically need the results of an outside check annually as part of their duty agreements. Therefore, most companies will have annual audits for one reason or another.

Managerial Accounting

Accounting Guest Post, Decision-making accounting uses much of the same data as financial accounting but organizes and utilizes information differently. Namely, in managerial accounting, an accountant generates monthly or quarterly reports that a business’s management team can use to decide how the company operates. Managerial accounting also encompasses many other facets of accounting, including budgeting, forecasting, and various financial analysis tools. Essentially, any valuable information to management falls under this umbrella.

What Types of Careers Are in the Accounting Field?

While a bookkeeper can handle essential accounting functions, advanced accounting is typically done by qualified accountants with titles such as Certified Public Accountant or Certified Management Accountant in the United States.

The three legacy designations in Canada—the Chartered Accountant, General Accountant, and Certified Management Accountant have been unified under the Chartered Professional Accountant designation.

A significant component of the accounting profession is the “Big Four.” These four largest accounting firms conduct audit, consulting, tax advisory, and other services. These and many other smaller firms comprise the public accounting realm that advises financial and tax accounting.

What Are Accounting Standards?

In most cases, accountants use generally accepted office principles. Preparing financial declarations in the U.S. GAAP is a set of standards and regulations designed to improve the comparability and reliability of financial reportage across industries. Its criteria are double-entry accounting, in which every accounting transaction is entered as a debit and also credit in two general ledger accounts that will roll into the balance sheet and also the income statement.

In most other countries, a set of standards is governed by the International Accounting Standards Board and the International Financial Reporting Standards.

Tax accountants’ supervision returns in the United States rely on guidance from the Interior Revenue Service. Federal tax returns must comply with tax guidance outlined by the Internal Revenue Code. Tax accounts may also lean in on state or county taxes as outlined by the business’s jurisdiction. Foreign companies must comply with tax guidance in the countries where they must file a return.

How to Submit Your Articles

To submit your post, us can send an email to contact@thewhoblog.com

Why Write for Us on The Who Blog – Accounting Write for Us?

Search Related Terms to Accounting Guest Post

- accounting

- wave accounting

- accounting equation

- forensic accounting

- accounting software

- accounting jobs

- big 4 accounting firms

- accrual accounting

- double entry accounting

- accounting jobs near me

- what is accounting

- accounting firm

- remote accounting jobs

- financial accounting

- accounting firms

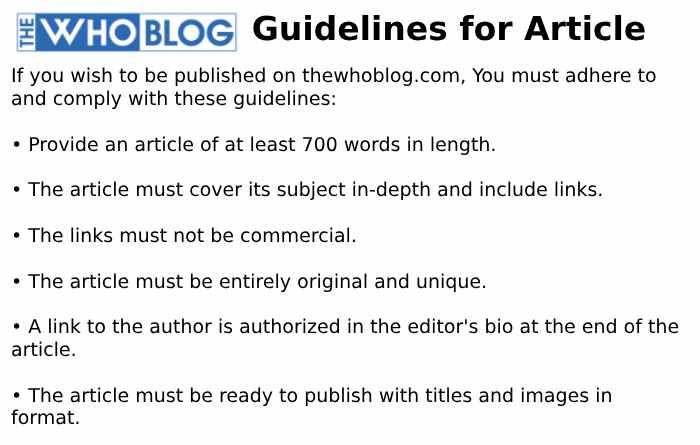

Guidelines of the Article to Writing Accounting Guest Post

You can send your mail to contact@thewhoblog.com

You can send your mail to contact@thewhoblog.com